While using protected phone calls, the brand new individual earns the newest advanced that will be asked to submit the newest offers should your client of your own call chooses to get it done your options. It’s suitable for traders whom believe the cost of the brand new stock tend to flow around laterally on the life of the fresh options bargain. A shielded call strategy relates to to find 100 offers of your own hidden investment and promoting a visit choice against those people offers. If trader carries the call, the fresh option’s advanced are gathered, thus reducing the prices foundation to the shares and you can bringing particular disadvantage shelter. Inturn, by the offering the choice, the fresh buyer is actually agreeing to sell shares of the hidden at the option’s strike price, thereby capping the brand new trader’s upside potential.

Victory within the alternatives exchange demands a strong understanding of alternatives vocabulary, jargon and secret concepts. To even get started, you’ll often need to sign an agreement and you can convince the representative that you experienced everything you’re undertaking. Carolyn Kimball are handling editor for Reink Media and the direct publisher to the StockBrokers.com Annual Remark.

Is actually Protective Sets a waste of Money?

For example, for individuals who begin to focus on a startup, you happen to be considering stock options to possess a dozen,one hundred thousand offers of your own business’s stock within your settlement. These choices aren’t provided to your instantaneously; they vest more than a specified time. Thus once 1 year, you might be capable take action step 3,one hundred thousand offers, up coming some other 3,000 yearly then. For example, when the a trader are gambling one to Worldwide Team Hosts Corp. (IBM) often rise in the future, they might get a visit to have a specific day and a good sort of hit speed. Such, an investor is actually playing one IBM’s inventory often go beyond $150 from the center from January. The newest struck rates find if an alternative is going to be worked out.

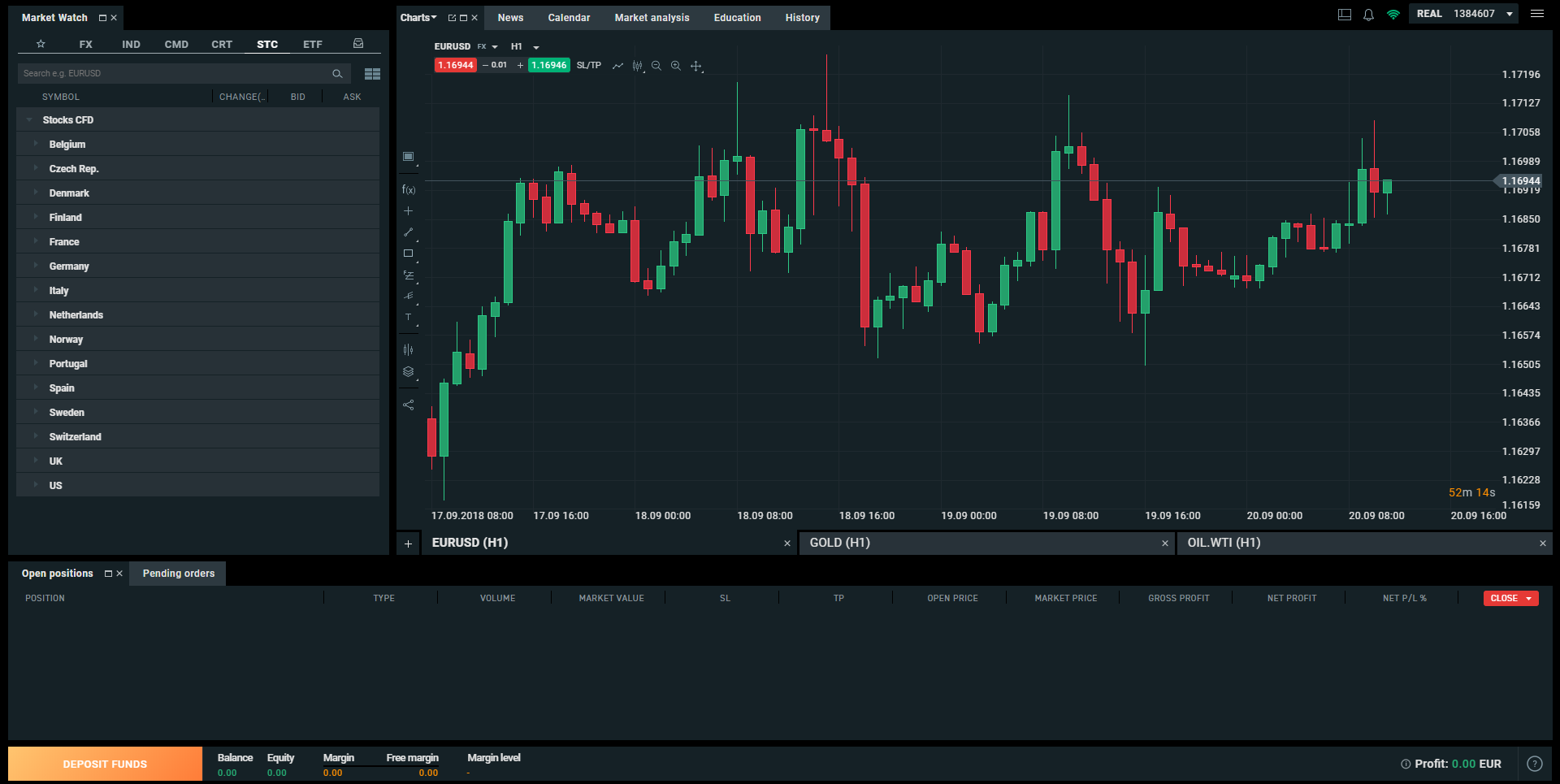

Options change platform systems research

In any event, the fresh designer provides the original $20,100000 gathered. A lengthy call can be used to imagine for the speed of your own fundamental ascending because it provides endless upside possible, nevertheless the restriction losses is the premium (price) taken care of the choice. A choice are a by-product since the its price is intrinsically linked to your price of something else. If you purchase an options deal, they gives you the correct although not the obligation to find or offer a main investment from the a-flat price on the otherwise prior to a certain go out. Regarding respecting solution contracts, it’s generally about determining the number of choices from coming rates occurrences. A lot more likely one thing should be to can be found, the larger an option one earnings of you to definitely experience do become.

That is titled 2nd-buy (second-derivative) rate sensitiveness. Gamma means the quantity the fresh delta manage changes provided a $step one move in the underlying security. Let’s hypothetically say an investor try enough time one to phone call choice for the hypothetical inventory XYZ.

The maximum money ‘s the advanced acquired whenever selling the possibility. A trader who sells a visit option is bearish and you will thinks the underlying stock’s speed usually https://voboc.org/quick-2000-proair-the-state-xbtc-club-platform-current-webpages-2024/ slide otherwise continue to be apparently close to the brand new option’s struck price within the lifetime of the option. Should your hidden inventory rate will not move over the hit rate because of the expiration day, the option expires worthlessly. The fresh manager is not required to buy the newest shares however, usually lose the newest superior paid for the phone call. As mentioned prior to, call options let the holder to buy a fundamental security in the the fresh stated hit price by conclusion day known as expiration.

American-design possibilities offer far more independency as they can become worked out during the any time prior to expiration. Even with their popularity, the reality is choices trading is not that quick therefore should be fairly tactical whenever delivering inside it. See stops working below exactly what effective traders would like to know ahead of giving they a-try. Western alternatives will be exercised when involving the day out of purchase plus the expiration date. European possibilities are different out of American alternatives in that they can only be resolved at the conclusion of its life on the expiration day.

If you put on a good 20-hit, 40-hit box, it does always expire value $20. Before termination, it would be value lower than $20, therefore it is for example a zero-coupon bond. Buyers have fun with packets in order to obtain otherwise provide fund for cash government motives with regards to the meant interest of the container. A laterally marketplace is one to in which prices do not alter far more time, therefore it is a decreased-volatility ecosystem.

It’s crucial that you fool around with a threshold acquisition (maybe not an industry order) when position choices trades, or you might end up which have a significantly various other rate to have their trading than simply your requested. Of several traders choose carries more choices, as they can nevertheless make glamorous efficiency along side long lasting, without any chance of total losses for the possibilities. If you believe offers is actually undervalued, pick a call choice expiring at some stage in the long run when you consider the market industry tend to comprehend the true property value the fresh shares.

Here is a list of the main alternatives change features offered by an informed possibilities change agents. This Greek ‘s the way of measuring a choice bargain’s sensitivity in order to changes in the cost of the underlying shelter. In case your underlying inventory, or any other defense, develops because of the one-dollar in expense, the option bargain is always to increase in rate because of the delta well worth (all else are equivalent). An alternative choice Greek, theta steps an option package’s reduction in rate along side second a day owing to date decay. Here is the number of alternative agreements having transacted today with this certain bargain.

Items including alterations in volatility have a significant impact, which is a good idea to arrange and you can take control of your exchange with your points at heart. Choices and offer traders entry to flexible and cutting-edge procedures. They are procedures which is often effective under any field standards, such as if the field movements laterally. Options can be healthy an existing inventory profile giving a professional hedge facing negative actions in the business. On the analogy over, we are able to comprehend the option conclusion date are Sep next and each other phone calls and places are given.