Blog post summation

- People from other countries or nonresidents can be put money into possessions inside South Africa as anyone, otherwise through-joint ownership or of the getting shares in the an entity you to definitely possess property.

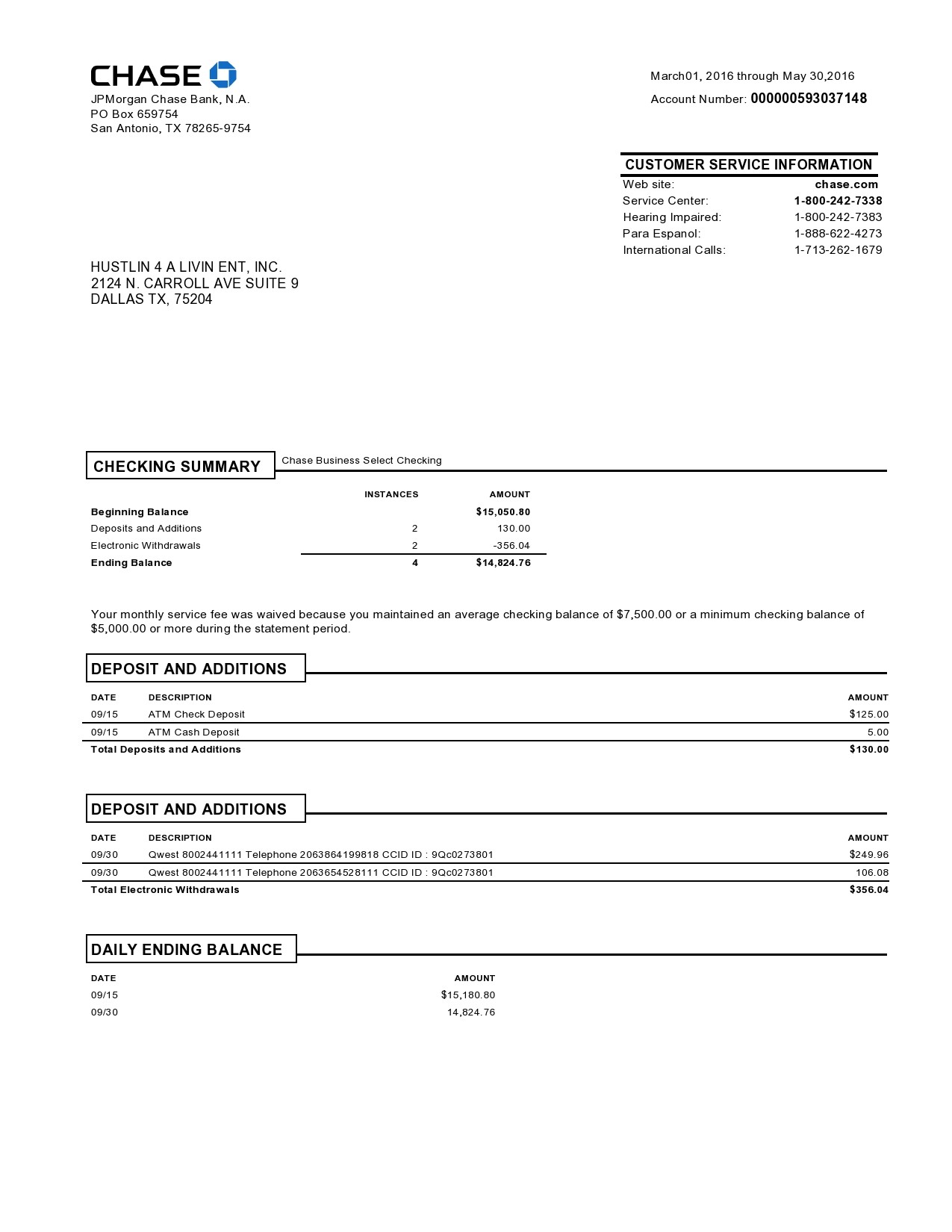

- Nonresidents need transfer 50% of one’s price otherwise harmony out of cost via the Set aside Bank, from their individual foreign financial to help you a selected membership (that will constantly become faith membership of your own moving attorney) with a registered South African lender.

- All foreigners, specifically nonresidents, need dedicate you to rand in the united states for each and every rand they need certainly to acquire. The quantity foreign people or nonresidents is borrow is limited in order to fifty% of the cost.

The new Southern African possessions sector continues to be a prime interest to possess international buyers, thanks to a beneficial rate of exchange and you may a great amount of luxury housing into the beautiful metropolises. Foreign resource is expected to help improve given that discount gradually recovers about Covid lockdowns.

What to realize about home loans to own people from other countries for the Southern area Africa

People from other countries not resident in South Africa, who happen to be keen to shop for property right here, will do thus individually or as one, or because of the acquiring offers inside the a friends that is the entered proprietor off a home.

step one. If you purchase property as a result of an estate broker, they have to be a registered person in brand new Estate Company Circumstances Board with a legitimate Fidelity Loans Certification.

2. Once you create a deal buying and is also approved, a contract out-of product sales could well be drafted on client, provider as well as 2 witnesses to help you indication. Which bargain are legally joining. In the event the sometimes the consumer otherwise vendor cancels this new arrangement during the 11th hour, they may be charged to own costs sustained, instance squandered legal charges.

3. Both the bring to find plus the agreement out-of selling need are fully understood before he or she is finalized and you may filed. You need to seek separate legal advice when the one thing is actually unclear.

cuatro. Possessions during the Southern area Africa is sold voetstoets (as is). However, the consumer should be informed of the many patent and latent flaws in the assets.

5. Accessories and accessories was instantly within the purchases of the assets. To own understanding, these may become placed in the brand new arrangement out-of sales.

six. Electronic and you may beetle licenses are required to concur that brand new electronic setting up was compliant with statutory conditions hence the house or property is perhaps not plagued because of the specific beetles. (The second certification might be simply required inside coastal places.) Certain countries want plumbing and fuel permits.

seven. Most of the foreign people maybe not citizen otherwise domiciled inside Southern area Africa must dedicate one to rand in the nation per rand they want to acquire. The total amount people from other countries otherwise low-residents can obtain is restricted to help you fifty% of your own cost. Approval are expected by exchange manage bodies, that may believe being able to confirm the inclusion to South Africa out of an expense equivalent to the connection loan amount.

8. Financial institutions simply financing 50% of purchase value of the property getting nonresidents. Therefore international traders usually possibly need certainly to promote an excellent 50% put, or pay bucks and you will present the full amount into the Southern Africa through the Reserve Bank so you can a selected savings account (that’ll always be the faith account of your moving attorneys) with a subscribed Southern area African lender.

9. The listing of one’s put of your own financing acquired from good international provider is referred to as a good deal acknowledgment and should be hired by the customer since it is expected towards the repatriation out-of funds if the property is sooner or later offered.

10. If it’s a combined software, a minumum of one candidate need to earn a minimum of R25 000 four weeks, feel 18 ages or elderly and also have a definite credit score.

What documents can i you need whenever making an application for home financing just like the a different trader?

- An individual Mortgage Interview Setting, signed and old. Instead you can loan by phone complete an internet application that have ooba Home loans:

- A copy of the ID or each party off a keen ID Cards Otherwise a foreign or Southern area African passport Otherwise a-work permit letting you really works abroad.

- A salary Pointers Otherwise a beneficial payslip towards the current six months (around distribution go out).

- A copy regarding an entire Bargain of Employment.

- A consumer Mortgage Interviews Setting, signed and you can old. As an alternative you could potentially over an internet application with ooba Mortgage brokers:

Obtaining a home loan owing to a south African financial

ooba Lenders is actually Southern area Africa’s largest home loan analysis service, and certainly will assist foreigners to purchase property in the Southern Africa once they get a bond because of a south African standard bank.

Audience never fundamentally need to unlock a banking account with you to industrial financial, as they possibly can import funds directly from the overseas membership to the their property mortgage account.

We are able to submit the application in order to multiple Southern African banking institutions, allowing you to compare packages and now have an informed bargain with the your home mortgage.

We supply a selection of products that can make the property techniques much easier. Start with our very own Thread Calculator, then explore our very own Bond Indicator to see which you can afford. In the end, as you prepare, you can get a mortgage.