This substitutes the creation of cash account, bank account, discount received and discount allowed in the ledger. A cash book is a financial journal that contains all cash receipts and disbursements, including bank deposits and withdrawals. This is the main area where businesses record any and all cash-related information.

What is the method of posting a three column cash book into ledger?

In the description column, the accountant writes a short description or narration of the transaction. In the reference or ledger folio column, the accountant inputs the account number for the related general ledger account. The single-column cash book is the easiest type of cash book to use.

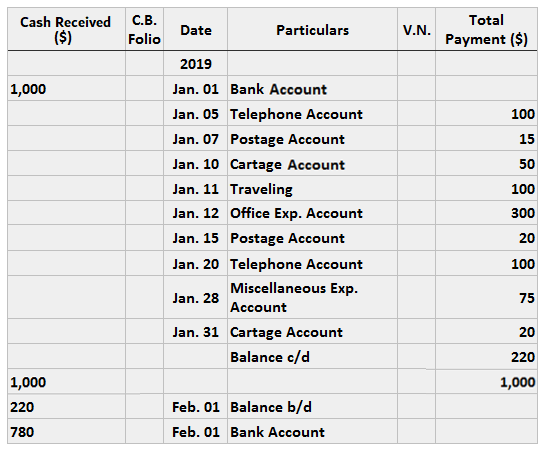

Example of a Simple Petty Cash Book

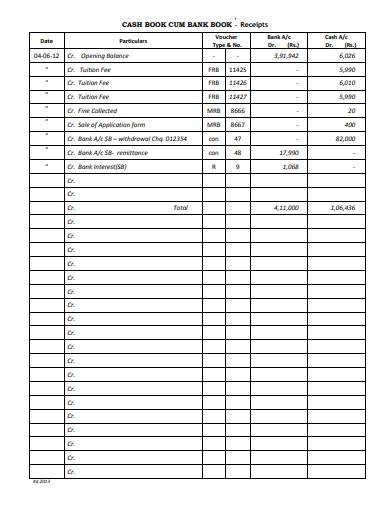

As before the first three columns in the diagram are the date, transaction description (Desc.), and ledger folio reference (LF). Therefore, the total debits in the ledger agree with the credit in the main cash book. In other words, the petty cash book does not form a part of double-entry bookkeeping. The petty cashier receives cash against the cheque from the bank and records the cheque in the receipts column of the petty cash book. A cash book contains receipts and payments of cash, credit sales, etc. It will show the date of the transaction, name of the customer (if any), account to be debited (positive amount) or credited (negative amount).

Where Should We Send Your Answer?

After recording the opening balance in the description column, the cash transactions of the current period are recorded. An overview of this procedure is given on the double column cash book page. Because the cash book is updated continuously, it will be in chronological order by transaction.

Posting entries from single column cash book to ledger accounts

- When a payment is made, an original receipt is obtained from the payee.

- When an account holder deposits money with the bank, the bank’s liability to the account holder is increased from the bank’s point of view.

- 11 Financial is a registered investment adviser located in Lufkin, Texas.

- The petty cashier receives cash against the cheque from the bank and records the cheque in the receipts column of the petty cash book.

- At the end of each month or another appropriate period, the amount column of both sides is totaled.

Angela is certified in Xero, QuickBooks, and FreeAgent accounting software. To simplify bookkeeping, she created lots of easy-to-use Excel bookkeeping templates. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

A bank account may have an overdrawn balance because by arranging an overdraft with the bank, it is possible that more money may be withdrawn from the bank than what was deposited. It is worth mentioning that the format of a three column cash book is similar to that of a two column cash book. This is the reason why discount columns are also provided in the cash book. Irrespective of the number of sub-divisions, each page of the cash book can have a number of formats from single column to multi-column. The most popular formats are the two and three column formats as detailed below.

If a payment is made by cheque, it will be recorded on the credit side in the bank column. The only exception is that a column is added in a three column cash book to account for bank-related transactions. Again, the three column cash ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit).

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. why you should hire an accountant for your personal finances 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

The double-column cash book (also known as the two-column cash book) has two money columns on both debit and credit sides – one to record cash transactions and one to record bank transactions. In other words, we can say that if we add a bank column to both sides of a single-column cash book, it would become a double-column cash book. The cash column is used to record all cash transactions and works as a cash account, whereas the bank column is used to record all receipts and payments made by checks and works as a bank account. Both the columns are totaled and balanced like a traditional T-account at the end of an appropriate period, which is usually one month. The following Cash Book examples outline the most common Cash Books.