Seaside Ridge and you will Goldman Sachs have bought Commons during the Sawmill, an effective 448-sleep pupil property community when you look at the Flagstaff, Ariz. Nelson Partners ended up selling the house or property, helping college students from the Northern Washington School, just after roughly six several years of possession. The firm received the community within the 2016 for $37.1 million. CBRE brokered the present day bargain.

Seaside Ridge will would town on 901 S. O’Leary St., lower than a distance on the NAU university. The house border a mix of studio, two- and four-rooms equipment starting ranging from 405 and you may step 1,200 square feetmunity services tend to be protected vehicle parking, a club with a fireplace, a health club, and a study city.

Inspired of the Arizona’s good people development, Flagstaff might a very good , North Arizona College got a maximum of twenty eight,718 enlisted students, which have 21,248 at Flagstaff campus, as outlined by the institution. Yearly book growth from the NAU try right up 10.3% as of February, whenever you are bed rooms around build accounted for dos.6% regarding registration, according to Yardi Matrix analysis.

The new state’s good entals and positive market trends drove Seaside Ridge to invest in Commons at Sawmill, Controlling Manager Dan Dooley said during the prepared reviews. The fresh government business operates more than 23,000 pupil casing beds all over the country.

Associated Questions

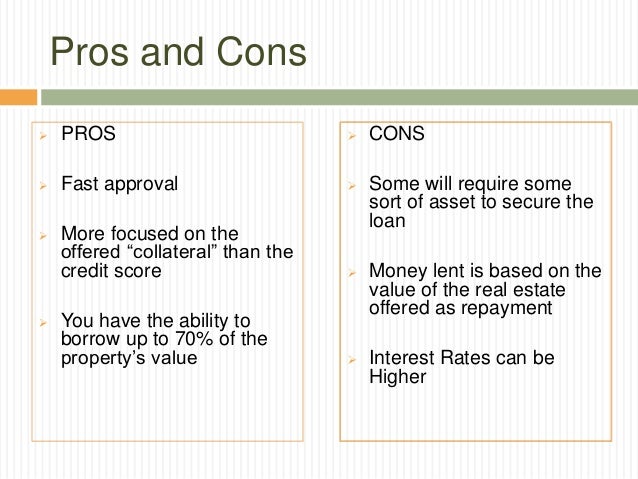

Investing in student houses organizations also provide an abundance of experts. They’ve been enhanced job opportunities, improved consumer expenses, and you may enhanced neighborhood high quality. At the same time, scholar construction organizations also have a steady flow out of local rental money, in addition to potential income tax benefits. Considering Multifamily.fund, student homes organizations may render traders which have increased get back to the resource than antique multifamily homes.

Do you know the threats regarding the investing in pupil housing organizations?

Investing in beginner property groups come with a number of threats. First of all, design costs possess grown substantially for the past very long time, which can affect reent strategies. Be sure to research your facts and you will plan to come which have a good strong funds before beginning flat home improvements to prevent people awful unexpected situations.

Framework delays also are an unfortunate reality out-of life, and due to also provide strings activities best bank for personal loans in Hawai, specific can’t be avoided. It could be better to simply take a highly traditional means in regards to any project timeline.

In the long run, their renovation performs can get simply not be adequate to get the financial support consequences you’re looking for. You can even dedicate a great amount of financing to incorporate the greatest-avoid deluxe amenities so you can a home produced in the fresh new 1980s – however, if potential clients seek a more recent strengthening, you may not come across most of an uptick in the occupancy otherwise rental money.

On top of that, characteristics inside the school towns typically have a top portion of student tenants. Although this about equates to a reliable supply of clients, the latest built-in seasonality from college dates can lead to seasonal vacancy circumstances.

Why does Goldman Sachs’ funding when you look at the Seaside Ridge benefit the Washington student housing market?

Goldman Sachs’ money inside the Seaside Ridge A residential property Lovers, a student housing funding enterprise, is expected to profit brand new Arizona beginner housing ilyBiz, the resource allows Seaside Ridge to grow its beginner property profile inside Arizona or other places. This new financing will even give the means to access Goldman Sachs’ commercial actual property resource circumstances, that’ll assist Coastal Ridge get more pupil property characteristics from inside the Washington.

Do you know the benefits associated with Coastal Ridge’s student homes area?

Seaside Ridge’s pupil homes society also provides numerous benefits to its owners. They’ve been entry to personal and you may health characteristics, community attributes, or other places. Public and you can health properties range from an in-webpages dietician visit to bring nourishment information, taught advisors of these dealing with traumatization, and you can career counseling from local leadership. As well, town even offers services such as for example a health club, swimming pool, and read sofa. This type of amenities can help pupils remain healthy and you will focused on the training.

What are the potential pressures from investing scholar housing groups?

Investing scholar housing groups can establish a few prospective challenges. One of several challenges is the seasonality out of college student tenants. Given that college students typically only stay-in the room for a few months out of the season, this can lead to seasonal vacancy affairs. At the same time, student clients elizabeth level of monetary balances since almost every other tenants, which can lead to challenge when you look at the collecting lease payments. Ultimately, scholar property organizations need more regular repairs and you will repairs owed to the high return speed of clients.

How come Goldman Sachs’ funding from inside the Seaside Ridge compare to other student homes investments?

Goldman Sachs might have been a major investor inside pupil housing, investing in a good amount of ideas nationwide. Within the 2021, Goldman Sachs offered an effective $97.8 mil mortgage so you can Coastal Ridge A residential property to your buy off students construction profile regarding the Midwest. This was one of the largest college student homes expenditures created by Goldman Sachs inside the 2021, therefore is actually part of a much bigger development out of improved funding during the college student homes of the firm. Based on a report from GlobeSt, Goldman Sachs could have been purchasing greatly during the beginner casing, into the corporation providing more than $1 million inside the beginner housing money inside 2020. This will be significantly more than this new $400 million inside beginner property fund you to Goldman Sachs given in the 2019.

Janover: Your ex inside Progress

During the Janover, we provide many properties tailored to your novel need. From industrial assets fund and LP government in order to loans and you may characteristics to own lenders, we are right here to help you allow.

This amazing site try owned by a pals that provides team recommendations, suggestions or any other attributes connected with multifamily, commercial home, and you may company money. We have zero affiliation having people authorities agency and are generally perhaps not a loan provider. We have been an occurrence organization that uses application and sense so you’re able to offer loan providers and you may consumers to one another. Applying this site, your invest in our access to cookies, our very own Terms of service and you may our Privacy. We play with snacks to offer an excellent experience and you can to greatly help our very own web site work at effortlessly.

Freddie Mac computer and you can Optigo are inserted trademarks regarding Freddie Mac. Fannie mae are a registered trademark out of Federal national mortgage association. We are not associated with brand new Service of Houses and you will Metropolitan Development (HUD), Government Construction Government (FHA), Freddie Mac or Fannie mae.

This amazing site utilizes phony cleverness technology so you’re able to car-create answers, which have limitations inside the reliability and you will appropriateness. Profiles shouldn’t rely upon AI-made stuff having definitive suggestions and rather would be to confirm points or request benefits out of any individual, court, monetary or other issues. The site manager is not guilty of damage presumably arising from access to it web site’s AI.