- Just how house equity financing and you can HELOCs examine

- House guarantee fund

- HELOCs

- When you do a property guarantee mortgage or HELOC?

Insider’s gurus pick the best products in order to make wise choices together with your currency (here is how). In some cases, i discovered a fee from our our partners, but not, all of our feedback are our personal. Terminology apply at also offers listed on these pages.

- Family security loans and you can HELOCs allows you to borrow secured on the newest worth of your property.

- Both are sorts of next mortgage loans, even so they disagree in the manner you have access to the finance and you will just how it is possible to pay them.

- You might generally speaking obtain doing 80% or 90% of your house’s value, without balance of your first mortgage.

If you need to borrow against the fresh new security you really have in your house, the second mortgage could be the best method to take action.

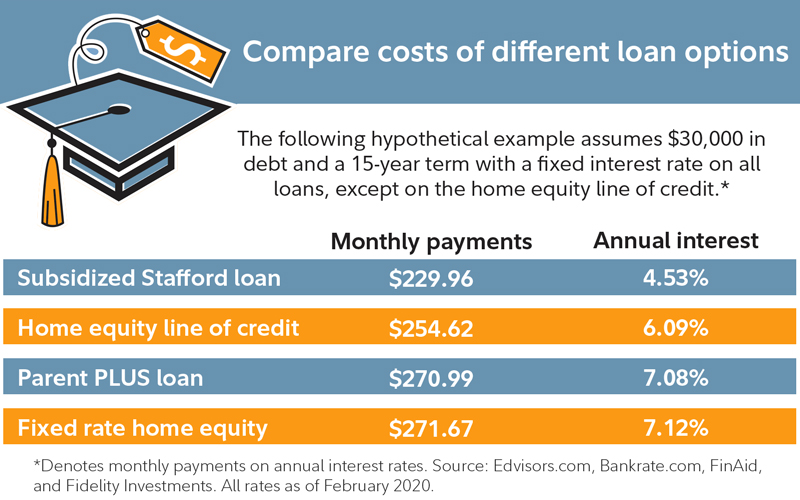

Rates of interest are usually down to the next mortgages than many other borrowing from the bank options, for example signature loans or handmade cards. And, inside a higher level ecosystem, an extra financial is typically easier to bringing a profit-away re-finance and you can possibly using up a significantly high rate into your first financial.

Family collateral lines of credit (HELOCs) and home guarantee financing are two type of second mortgage loans one to allow you to borrow on new security you’ve got of your house. Nevertheless these several family security issues aren’t effective in identical means. A knowledgeable complement you hinges on your position.

Just how house security finance and you can HELOCs compare

Household guarantee funds and you will HELOCs both will let you borrow secured on their residence’s collateral, and you can utilize the money in fashion. Generally speaking, individuals will use 2nd mortgages to fund such things as domestic fixes otherwise improvements,

Although way you’ll have access to the income and you can pay off her or him varies with respect to the version of second home loan you earn.

Household security funds

Family security funds let you borrow against the newest equity on the house and located your own funds in a single lump sum. Financing wide variety are generally simply for your loan-to-well worth proportion, or your home value without your existing mortgage equilibrium. Typically, you can get a property guarantee mortgage doing 80% or ninety% of the residence’s well worth, without your existing home loan harmony.

Including personal loans, family security fund feature a fixed rate of interest and repaired cost term. Thanks to this, additionally, you will score a fixed payment per month that does not change throughout living of your own loan. Home guarantee loans are extremely predictable; you probably know how much you might be borrowing from the bank, just how long it will probably elevates to spend it back, and just how much you’ll be able to are obligated to pay each month.

Understand in advance in the event your lender charge an excellent prepayment penalty, in case you need certainly to pay-off the borrowed funds before schedule, and just how much you will end up expected to pay inside costs and you will settlement costs. Various other loan providers keeps more payment structures – certain have quite lower costs – so you need to contrast the options.

- Repaired payment

- Your own rate of interest won’t changes

HELOCs

Where domestic collateral funds function much like a personal loan, household collateral credit lines, otherwise HELOCs, functions similarly to a charge card. In place of providing you a lump sum payment, a beneficial HELOC try a credit line you might borrow on when you really need the cash. Therefore, you will simply repay degrees of money your obtain from the end.

Like home equity money, HELOCs always curb your borrowing power to doing 80% otherwise ninety% of the residence’s well worth, and can even otherwise might not include charges with regards to the financial. They generally come with a variable interest, while some loan providers provide the substitute for move part of their equilibrium so you can a fixed rates.

HELOC repayment try put into a few attacks: the fresh new draw several months and the fees months. Commonly loan with 500 credit score, a blow months lasts a decade plus the fees usually become dispersed more than 2 decades, however, identity lengths may vary.

You can simply be in a position to just take money aside from inside the draw several months. Specific lenders has minimum withdrawal criteria, but aside from that, you should have this new freedom so you can use only that which you become trying to find – definition it is possible to only pay attention with the count your use.

Inside mark months, you are able to generally make notice-merely money. Just like the installment months begins, you can no more have the ability to generate distributions throughout the HELOC, and you might start making monthly premiums that include both the dominating and you can interest.

Their self-reliance tends to make HELOCs a good idea while you are taking care of an unbarred-ended opportunity and you may commonly yes just how much you need full.

But because your payment is dependant on just how much your borrow along with your interest rate are changeable, your payment amount tends to be tough to assume – therefore you may vary throughout the years.

If you do property collateral financing otherwise HELOC?

If you want a predetermined month-to-month interest and a fixed percentage and you can know precisely how much cash you would like, a home equity mortgage is likely the top for your requirements.

Or even mind a changeable rate of interest and want to obtain since you go, simultaneously, a beneficial HELOC could well be top. Remember that the payment you will vary since rates increase or you obtain alot more.

Another thing to imagine ‘s the threat of credit regarding your residence’s security, whatever the sort of mortgage you use. For people who standard on the 2nd mortgage, the financial institution get foreclose and you also you will definitely cure your property. Getting a property equity mortgage or HELOC is not always an adverse idea, but it is important to envision what exactly is at risk when taking away a loan on your family.