However, it could be very important carefully think about the advantages and drawbacks of this kind of mortgage and compare it to different choices, corresponding to a traditional reverse mortgage or a home equity loan. By doing so, seniors could make an informed choice that meets their monetary needs and goals. Proprietary reverse mortgages are a type of residence fairness loan that permits owners to transform a portion of their home equity into cash with out having to promote their house or make monthly mortgage funds. In this blog, we have dispelled frequent misconceptions about proprietary reverse mortgages and explored their options and advantages.

Such a staff might include professionals skilled in sustaining and optimizing the buying and selling infrastructure, including connectivity, software program, and data feeds. Moreover, the collaborative nature of prop buying and selling can foster a unique sense of partnership between merchants and the brokerage. Prop merchants aren’t just shoppers; they are lively members who contribute their trading expertise to the general trading ecosystem.

Traders use various risk administration methods, similar to diversification and hedging, to attenuate potential losses. A third advantage of prop trading is that it permits monetary establishments to be influential market makers. These establishments can play an important role in enhancing market stability by constantly offering liquidity for particular securities or teams of securities. The process entails the agency using its sources to buy securities and then selling them to involved traders at a later date. It is important to recognise that if the worth of the securities in the firm’s stock declines significantly, the agency itself must take up the losses. Therefore, the agency really advantages when the value of its security stock rises or when others purchase it at a better price.

Modern Prop Buying And Selling

Another essential requirement for proprietary merchants is the necessity to maintain accurate information. The CFTC requires traders to keep detailed records of all trades, including the date, time, price, and quantity of each transaction. While there are tons of advantages to Proprietary Trading in Futures, there are also significant risks concerned. If a financial institution makes a bad trade, it can lose a significant amount of its own capital. Additionally, Proprietary Trading can be subject to market volatility, which might result in sudden and surprising losses.

Training might include one-on-one teaching, market evaluation, suggestions from seasoned professional merchants, and periods with dedicated trading psychologists. This steady skilled improvement helps merchants improve their understanding of financial markets, refine their methods, and finally improve their trading performance. Traders are liable for making investment selections and executing trades, whereas analysts present analysis and insights to help trading strategies.

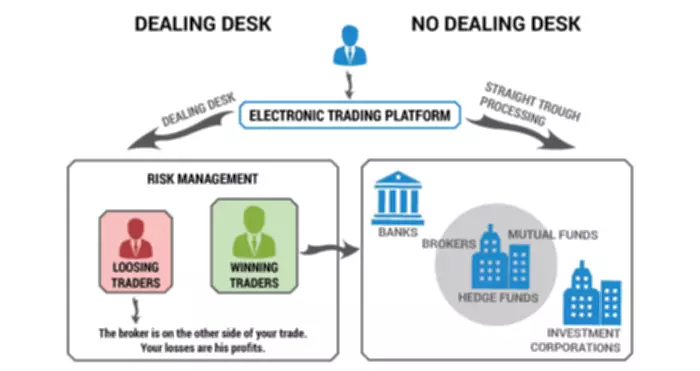

Firms operate with their very own capital and don’t deal with client funds, they’re exempt from lots of the regulatory requirements that brokers are topic to. This includes laws related to buyer safety, segregation of client funds, and investor compensation schemes. As a outcome, prop buying and selling companies have extra flexibility of their trading activities and are not certain by the same strict regulatory framework that governs brokers. Acting as financial backers for professional merchants, prop trading brokerages present them with the necessary capital to execute buying and selling methods within the financial markets.

High-frequency Buying And Selling Companies

Independent proprietary trading firms provide merchants with higher flexibility in phrases of trading strategies, however in addition they come with greater dangers since merchants bear full duty for any losses incurred. These firms utilise their funds to interact in trading activities throughout completely different financial markets, employing numerous proprietary buying and selling methods. As we age, our monetary wants and priorities change, and our homes can turn out to be a useful asset to assist us meet those needs. In the past, the one possibility for accessing the fairness in our homes was through a conventional reverse mortgage.

Discover the fundamentals of market liquidity, major forex pairs’ liquidity levels, factors affecting liquidity, liquidity providers’ position, risks of low liquidity, and tailored trading methods. The primary cause for the Volcker Rule is to separate proprietary buying and selling from other normal banking actions. The considering behind it’s that prop buying and selling could expose these establishments to extreme risk. This may then lead to the security of customers’ deposits and the general stability of the banking system being jeopardised. Another significant advantage is the flexibility of these establishments to construct up a list of securities. Firstly, it allows the institution to supply unexpected benefits to shoppers, which enhances their choices.

We use Modern Prop Trading primarily to refer to the completely different relationship between a dealer and the agency they commerce for. Hantec Markets doesn’t offer its companies to residents of certain jurisdictions together with USA, Iran, Myanmar and North Korea. Proprietary rights may help identify who owns the mental property that a startup owns. If someone else claims ownership of the mental property, it could be difficult to prove that the possession is reliable. FasterCapital will become the technical cofounder to assist you construct your MVP/prototype and supply full tech growth services. And if you get fired as a outcome of underperformance, it’s really tough to win a buying and selling job at a different firm.

Foreign Exchange Danger The Method To Calculate Your Returns

Another advantage of proprietary reverse mortgages is that they don’t require mortgage insurance coverage premiums (MIPs), that are typically required with FHA-backed reverse mortgages. MIPs can add significant costs to a reverse mortgage, so not having to pay them can save householders thousands of dollars over the lifetime of the mortgage. Additionally, some proprietary reverse mortgages may have decrease interest rates than FHA-backed reverse mortgages, which may further reduce the general value of the mortgage.

In this text, we’ll delve into the idea of a liquidity supplier vs. market maker, their features, and the way they impact merchants’ experiences and the market as an entire. Implementing development following as a method involves establishing specific benchmarks for entry and exit factors in a stock commerce. These benchmarks are sometimes decided by a share enhance or decrease within the inventory price, historically indicating whether or not the inventory will experience a rise or fall within the upcoming buying and selling classes. By intently monitoring and projecting financial and monetary policies worldwide, these funds have interaction in extremely leveraged currency trades utilizing futures, forwards, choices, and spot transactions.

Since we all know that psychology is very important in trading, we also offer our shoppers within the FTMO Account stage companies of a efficiency psychologist who can help them obtain even higher results. Traditional Proprietary Trading entails allocating real capital to a trader who’s physically current on the agency’s office. This trader is well-known to the firm, which supplies not only the required know-how but also an everyday salary. Working with an adviser could include potential downsides corresponding to fee of fees (which will reduce returns). The existence of a fiduciary obligation doesn’t prevent the rise of potential conflicts of curiosity.

Fed Price Cuts For 2024: Anticipation Builds As Fed Indicators Potential Fee Discount

Moving ahead, the longer term outlook for capital allocation in proprietary trading appears promising. With advances in know-how and elevated entry to information, merchants have more instruments at their disposal to make informed choices about capital allocation. Additionally, the expansion of other investment methods, similar to quantitative buying and selling and machine learning, has opened up new avenues for capital allocation that had been beforehand unavailable.

The prop companies usually additionally offer personalised training and mentorship applications for their traders. Through mentorship and coaching, prop merchants can enhance their proficiency in trading a wide range of monetary instruments. The most successful prop corporations often make investments probably the most time and money into their merchants. As a futures dealer, you must concentrate on the regulatory requirements for proprietary trading in futures.

This helps prop corporations establish purchasers with the most effective potential for trading in actual markets. Traditional reverse mortgages have strict eligibility requirements, similar to age, home value, and equity. Proprietary reverse mortgages, nevertheless what is proprietary trading, can have extra versatile eligibility necessities. For example, some proprietary reverse mortgages might enable debtors with decrease credit scores or higher debt-to-income ratios to qualify for the loan.

Proprietary expertise refers to any expertise that is owned and controlled by a specific firm or particular person, rather than being available for basic use. Companies that develop proprietary expertise can use it to create services and products that aren’t obtainable from their rivals. This can provide them a big advantage https://www.xcritical.com/ in the market, permitting them to dominate their industry and improve their market share. In this part, we will discover the benefits of proprietary know-how for market dominance. When comparing a proprietary reverse mortgage to a traditional reverse mortgage, it’s important to consider the specific needs of the borrower.

Payment Choices

For example, some proprietary reverse mortgages might provide a lump sum fee, a line of credit score, or a mix of each. Another good thing about changing into a funded trader is the potential to diversify trading methods. Proprietary trading firms often present entry to various financial markets and devices. Many proprietary buying and selling firms today use complicated methods and approaches that won’t swimsuit every trader.