In 2006, she obtained her MS in Accounting and Taxation and was diagnosed with Hodgkin’s Lymphoma two months later. Instead of focusing on the fear and anger, she started her accounting and consulting firm. In the last 10 years, she has worked with clients all over the country and now sees her diagnosis as an opportunity that opened doors to a fulfilling life.

Advantages and Disadvantages of the Variable Costing Method

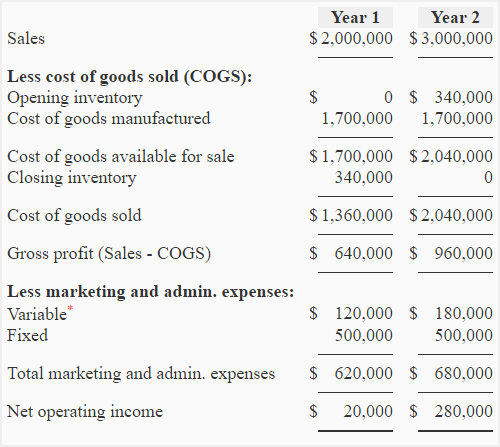

We will use overhead absorption costing, which is absorption by labor hour. Using the cost per unit that we calculated previously, we can calculate the cost of goods sold by multiplying the cost per unit by the number of units sold. Net income on the two reports can be differentif units produced do not equal units sold. The question only gave us the 170,000 manufactured units and 140,000 sold units.

4: Comparing Absorption and Variable Costing

This information must be interlaced with knowledge of markets, customer behavior, and the like. The resulting conclusions can set in motion plans of action that bear directly on the overall fate of the organization. Variable costing data are quite useful in avoiding incorrect decisions about product discontinuation.

- Therefore, fixed overhead will be allocated by $ 1.50 per working hour ($ 670,000/(300,000h+150,000h)).

- Fixed manufacturing overhead costs go to the balance sheet when incurred and are not expensed until sold.

- It is important to note that the variable items are only calculated based on the number sold.

- This method of full absorption costing becomes very important is there is the need to follow the accounting principles for external reporting purposes.

Find the talent you need to grow your business

But we can see that the manufactured units are 170,000, which means that 20,000 extra units have been produced. These extra units include the element of fixed cost because our absorption rate has both variable and fixed costs in it. can you claim your dog on your taxes The difference between variable and absorption costing is that different management prefers to use one method more for decision making than the other. Fixed overhead is not always included in the value inventory of variable costing.

Absorption Costing vs. Variable Costing: An Accounting Perspective

Absorption costing is a tool used in management accounting to capture entire expenses connected to manufacturing a certain product. For external reporting, generally recognized accounting principles (GAAP) demand absorption costing. In contrast to the variable costing method, every expense is allocated to manufactured products, whether or not they are sold by the end of the period. Recognize that a reduction in inventory during a period will cause the opposite effect from that shown.

Let us understand the concept of absorption costing equation with the help of some suitable examples. Having a solid grasp of product and period costs makes this statement a lot easier to do. Calculate unit cost first as that is probably the hardest part of the statement.

Most companies use cost pools to represent accounts that are always used. As you can see, by allocating all manufacturing costs to inventory, absorption costing provides a more comprehensive assessment of profitability. Most people, especially those in accounting, would have questions to ask about absorption costing and income statements.

With absorption costing, gross profit is derived by subtracting cost of goods sold from sales. Cost of goods sold includes direct materials, direct labor, and variable and allocated fixed manufacturing overhead. From gross profit, variable and fixed selling, general, and administrative costs are subtracted to arrive at net income. It is the presentation that is typical of financial statements generated for general use by shareholders and other persons external to the daily operations of a business. The absorption and variable costing methods are the two major methods that firms use to increase work value in the process and finished goods inventory for financial accounting.